1200

627

1200

627

Written by

Simon Jackson

Simon bring more than 20 years of experience in cloud architecture, networking, infrastructure design. He holds a BSC in Physics from Lancaster University and a postgraduate Master's programme in Cloud Computing from Caltech CMTE as well as holds the globally respected CISSP certification. His academic and professional background spans Microsoft Azure, Amazon Web Services (AWS) and Google Cloud Platform (GCP), underpinned by a strong focus on AI, DevOps and Automation.

Introduction

This report outlines the financial severity of cyber incidents affecting UK organisations. Using recognised modelling from Cyentia Institute’s IRIS dataset, KPMG summarised the economic impact by organisation size and sector. The UK Government later republished these findings, recognising the significance of the underlying analysis.

Cyber Risk Landscape

The latest independent research underscores that cyber-risk is not just a technology fault line – it is a business critical threat. According to the summary published by the National Cyber Security Centre (NCSC) on behalf of the UK Government, the average cost of a significant cyber incident for a UK business is almost £195,000.

When this cost is scaled across the national economy the annual estimate reaches approximately £14.7 billion, equivalent to about 0.5 % of UK GDP.

The term “significant cyber incident” is defined in the modelling as a successful event that imposes direct costs of at least £500.

Importantly, the data also show that the highest average incident costs are clustered in sectors such as information (£337,000), manufacturing (£330,000), and management services (£334,000).

This establishes several key takeaways:

- The cost of cyber-incidents is no longer marginal – it is financially material even for smaller organisations.

- Risk is emerging not only from standalone events but from the cumulative exposure across multiple incidents and sectors.

- Businesses in asset-intensive or data-dependent sectors face higher financial exposure.

- Rather than treat cyber-security as a purely IT challenge, businesses should recognise it as a risk to cash-flow, reputation, and continuity.

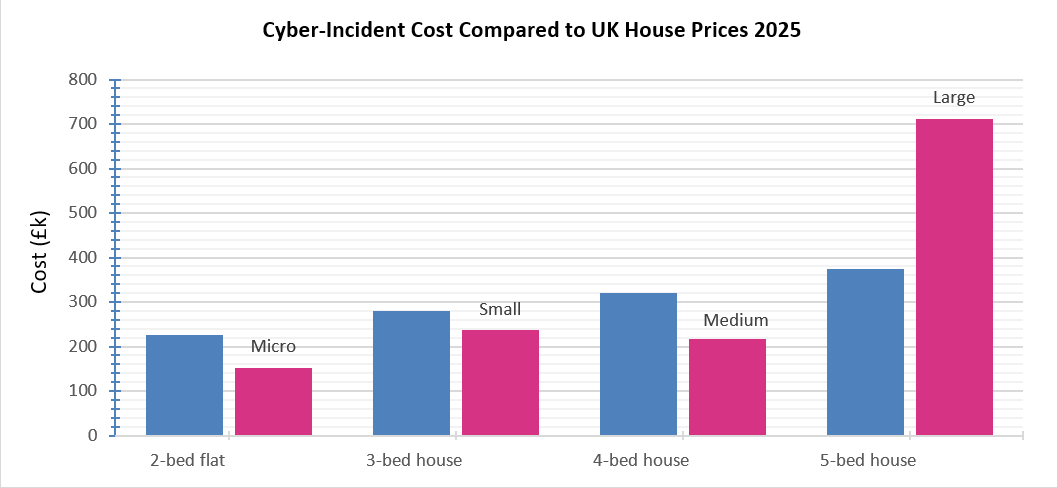

UK House Prices

Representative values based on Nationwide’s House Price Index (HPI June 2025) include

- 2-bed flat: approximately £225,000

- 3-bed house: approximately £280,000

- 4-bed house: approximately £320,000

- 5-bed house: approximately £375,000

Comparison Chart

The next chart places the average cost of a significant cyber incident (~£195,000) in context by comparing it with typical UK home-prices. The cyber-impact figure is taken from the KPMG (2025) modelling study as summarised by the Department for Science, Innovation & Technology (DSIT) in its ‘Independent research on the economic impact of cyber attacks on the UK’:

Methodology and Data Lineage

The data presented originates from the Cyentia Institute’s Information Risk Insights Study (IRIS).

KPMG’s study derived the IRIS dataset combined with UK survey data (e.g., the Cyber Security Breaches Survey). Reinforcing the credibility of the figures while acknowledging all assumptions involved. KPMG used this dataset to model sector-by-sector and size-specific estimated economic impacts.

The UK Government subsequently published a summary referencing KPMG’s work, validating the importance of this analysis.

Strategic Importance for UK SMEs

For small and micro businesses, the financial shock from an incident can exceed operational resilience. Aligning cyber practices with business value protects long-term stability and maintains customer trust.

How Alltime Technologies Supports You

Alltime Technologies provides strategic, operational, and technical support to help organisations reduce cyber risk. As an IASME Cyber Essentials Certification Body recognised by the NCSC, our qualified consultants guide organisations through practical, robust security improvements, including policy design, security controls, readiness assessment, and operational uplift.

Give us a call, perhaps we can help?